You’ve invested over the years and now you’re ready to retire and withdraw income from your retirement nest egg. How long will your money last? There are a number of variables at play, but one you should know is the sequence of returns. If you start taking income withdrawals from your portfolio in a down

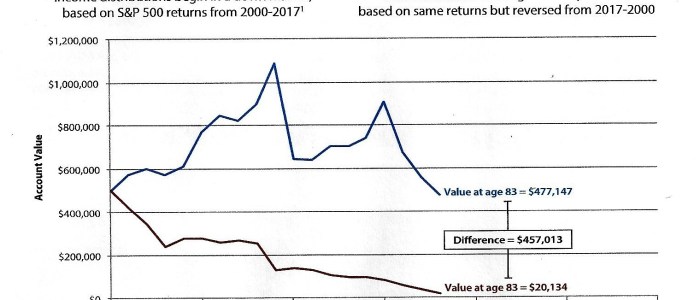

Early Negative Returns vs. Early Positive Returns Hypothetical Example

Jim, age 65, has $500,000 in savings invested in an index fund that mirrors the performance of the S&P 500®. He begins to withdraw 5% each year for income.

Compare the difference in his portfolio balance in the graph below. In each scenario, the average annual rate of return is 4.95 percent. But starting withdrawals in years with negative returns yields a very different portfolio outcome than when withdrawals begin in years with positive returns.

At age 83, Jim has only $20,134 left in account value (scenario A), when withdrawals began in a

Leave a Reply